BSE: 532540 NSE: TCS ISIN: INE467B01029 SECTOR: IT Software Company Company’s Website: tcs.com IPO Date & Price: July 29, 2004 | Rs. 775.0 -900.0

TCS Overview:

| Stock Symbol in NSE | Stock Symbol in BSE | Current Price | Market Cap. (Cr) | P/E Ratio | Current EPS |

|---|

TCS Sector Performance and Peer Comparison with Sector Analysis:

| Stock Symbol | Compnay Name | Market Cap. | Current Price | 52 Week High | 52 Week Low | P/E Ratio | EPS | Down 52W High | Day Low |

|---|

Did You Know?

- TCS is the Largest IT company of India.

- Its Belong to TATA Group.

- IRCTC Railway Ticketing system was build by TCS.

Balance Sheets & Profit & Loss Account:

| Year | Mar 2009 | Mar 2010 | Mar 2011 | Mar 2012 | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 |

|---|

TCS Share Price Forecast Based on Current Growth +5/-5:

Share Price and EPS Forecast Based on Current Average Growth Rates:

| Forecast | Next 5 Year (CG) | Next 10 Year (CG) | Next 20 Year (CG) |

|---|

Share Price and EPS Forecast Based on Current Average Growth Rates Plus 5%:

| Forecast | Next 5 Year (CG+5%) | Next 10 Year (CG+10%) | Next 20 Year (CG+20%) |

|---|

Share Price and EPS Forecast Based on Current Average Growth Rates Minus 5%:

| Forecast | Next 5 Year (CG-5%) | Next 10 Year (CG-10%) | Next 20 Year (CG-20%) |

|---|

TCS Quarterly Result, Date & Street Estimate:

Fundamental Analysis of TCS:

TCS Share Long Term Investment Price Target:

| TCS Long Term Investment Tagets | Price | Qnt.Ratio |

|---|

TCS Fundamentals SWOT Analysis by AMT

Strengths, Weaknesses, Opportunities, and Threats of TCS

S

- Strengths Analysis will coming Soon.

W

- Weakness Analysis will coming Soon.

O

- Opportunity Analysis will coming Soon.

T

- Threats Analysis will coming Soon.

Where we can See TCS in Next 5 Year, 10 Year & 20 Year?

IT is the future, have you ever thought a life without Technologies? Just imagine how much Technology we adopt in just past 5 years. If you are looking around your society you can see people are addicted to the gadgets and software like Smartphone, Tablets, computer, and so many awesome software, apps and websites that make our daily work simplify.

So no doubts that in the coming future Information Technology will be essential for our life.

Now let’s talk about TCS (Tata consultancy services), Its the largest IT company in India and Ranked 11th among worlds largest IT Service provider. TCS is operated in 64 Country all over the world.

So what we do I think on How far TCS can go in Next 5 Year, 10 Year & 20 Year?

Before I answer you this million-dollar question lets understand a –

The difference between TCS and World famous technology company like Google, Microsoft Amazon, Facebook and IMB.

Well, the Deference is huge-

Tata consultancy services:

TCS is a Service based company, where Google, Microsoft, Amazon are products based company. Let’s say you have a big Hotel business company with 100’s of 5 Start hotel is there. So you need a software and websites for Room booking management, cancellation, refund and online status check of room availability. This type of software service will be provided by TCS.

So TCS Earn money by build Software Application for there Enterprise customer, Even they earn by maintenance those applications.

Other Tech Giant like Google, Microsoft, Amazon:

Now let’s talk about the company like Google, Microsoft and Amazon. This is the company where they build their application for the universal purpose. Like google has Google Search engine, Gmail, YouTube, Drive, Google Cloud etc.

Microsoft has Windows OS, Microsoft Office, Microsoft Outlook etc. Amazon has Amazon Ecomerce and AWS,

So this is the company don’t need regular projects for there earning, Once then build a universal product then they keep earning from them.

Unlike TCS, They have a huge number of employees and needs regular projects to feed them.

Now you know the deference, next try to figure out the future of TCS:

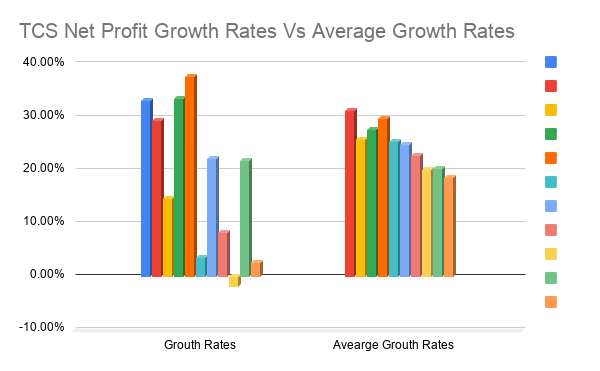

Though TCS gives a Good return of 20%-25% growth in the last 10 year. But there is some drawback and threats of TCS business model.

TCS needs regular projects for running there company and employee. So they are very much target oriented and timeline-based company, that’s why it’s not a future proof company compare to Top tech like Google, Amazon.

TCS is not a company for dreaming and innovation, and without dreaming and innovation there less changes big thing happen in the next 10-20 years.

Risk of Artificial Intelligence: Google, Amazon is already progressing in term of building there AI. AI will be next big threated for Service orientated company like TCS, Infosys and Tech Mahindra.

10 Year Target: Since TCS itself a Service related company and there earning depend on projects they manage Acquire. So we can’t expect a big boom in TCS in the next 10 Years.

Technical Analysis of TCS:

TCS Share Weekly Swing Trading Price Target:

| Demand And Supply Zone | Support Levels | Support Price | Resistance Levels | Resistance Price |

|---|

TCS Share Today Intraday Price Target:

| Levels | TCS Share Price IntradayTarget Today [Short Selling] | TCS Share Price IntradayTarget Today [Long Buying] |

|---|

TCS Future Trading Strategy:

Coming Soon.

TCS Option Trading Strategy:

Coming Soon.

FAQ on TCS:

Yes, TCS is India Number-1 IT Software company, with lots business potential in next few year. Its Fundamentally strong Stock we recommend to buy at around 20-25 PE Ration price target. Anyway This company is quite famous for Good Dividends.

TCS is a Debt free company. Its can easily survived any down turn for 5-10 Quarter business growth.

Recently TCS announced a Buyback and Stock price Hit 2800.00 , Its look like a bit over valued for a long Term Investor.

After buyback if stock price going upto 4000 and sustain for 6-8 month may be TCS Opted for a 1:1 Split.

Both and working as a Software service provider company from India. Its very tricky to sat which one best, Since Stock Market is full of risk we recommend to break your investment between this two company equally.

TCS may Declare a Diwali Bonus for Share holder and there employee. Still now no update.

Do to Covid-19 pandemic TCS Share drastically fall.

2020 Buyback announcement is the key reason for TCS Share to going up.

Its depend on when you and at what price you have buy this share, TCS at 20-25 P/E Ration is a excellent buy call for long Term Investment.

6.5 lakh for Freshers.

Yes, Its a Good for Freshers who want to work in India.

TCS’s Products/Projects:

Banking: RBS, DB, CITI, SBI.

Railway: IRCTC.

Airlines: Lufthansa.

ABB, Siemens etc.

TCS IPO Date, Price, GMP, Review, Analysis & Details:

TCS First IPO was initiate on July 29, 2004. 55,452,600 equity shares were put on sale during the IPO with a price band of Rs 775 -Rs 900 per equity share.

TCS Split, Bonus, Dividend Buyback History:

Company Profile:

CEO: Rajesh Gopinathan | Salary:

CFO: Samir Seksaria | Salary

Address:

Contact Number:

Email Address: